Ram Commercial Truck Tax Benefits

Ram Commercial Truck Tax Benefits

Let Columbiana Chrysler Dodge Jeep RAM Save You Money!

Are you a business owner? Are you considering buying a new company vehicle? IF so, you may want to consider purchasing a commercial truck or van from Columbiana Chrysler Jeep Dodge Ram. There are unique tax benefits for companies that buy these vehicles, as you may qualify for some lucrative tax breaks. Individuals who own a business or are self-employed and use their vehicle for business may deduct truck expenses on their tax returns. If a taxpayer uses the car for business and personal purposes, the expenses must be split. The deduction is based on the portion of mileage used for business.

Section 168K

Ram trucks and vans are typically considered qualifying property for purposes of section 168K for U.S. federal income tax purposes. Under this tax law, you can elect to treat the cost of any qualified property as an expense allowed as a deduction for the taxable year in which the property is acquired and placed in service.

Section 179

According to section 179, a Ram truck is considered property for U.S. federal income tax purposes. This means a taxpayer may choose to treat the cost of any Section 179 property as an expense and allow it as a deduction for the taxable year in which the property is acquired and placed in service. Under this law, owners may expense up to $1,050,000 of the property’s value during the current tax year.

Bonus Depreciation

Under current law, new and pre-owned heavy SUVs, pickups, and vans acquired and put to business use in 2021 are eligible for 100% first-year bonus depreciation. The only prerequisite is that the vehicle must be used more than 50% of the time for business. If your business usage is between 51% and 99%, you can deduct that percentage of the cost in the first year the vehicle is placed in service. If applicable, the 100% first-year bonus depreciation write-off will reduce your federal income tax bill and self-employment tax bill. You might get a state tax income deduction, too.

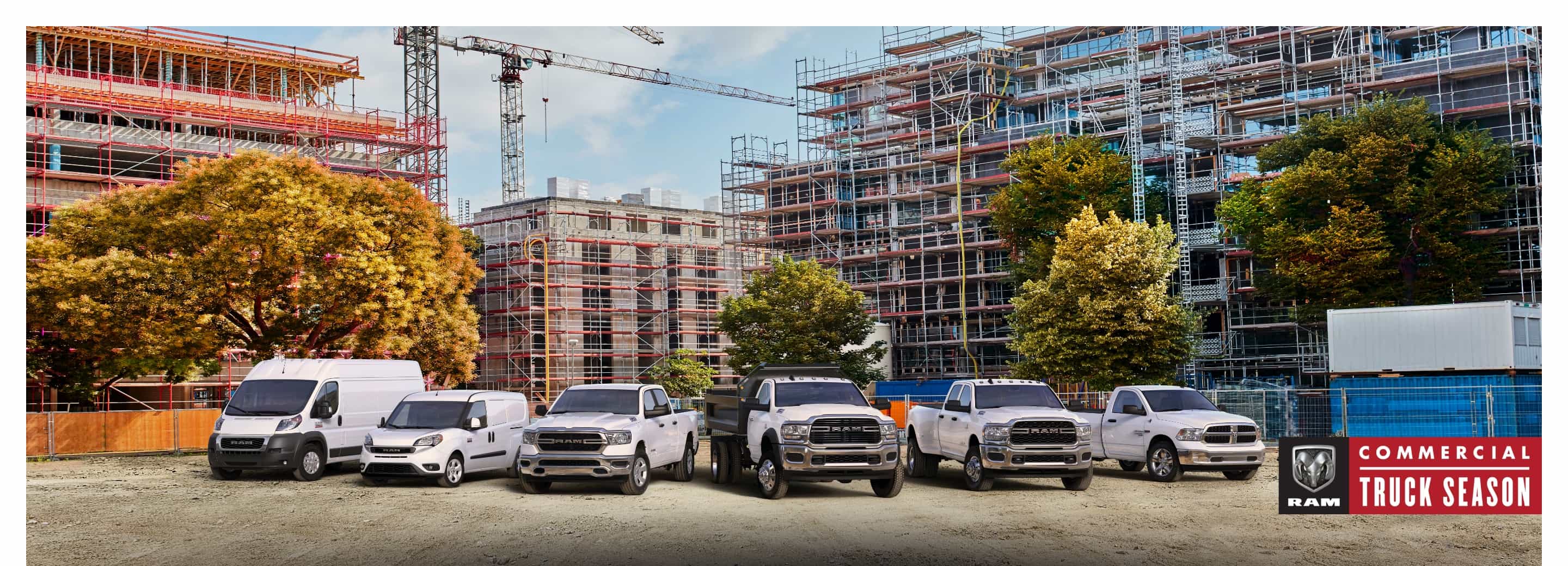

Visit Columbiana Chrysler Jeep Dodge Ram For You Next Commercial Truck

If you would like to learn more about the outstanding tax benefits your company could receive by purchasing a Ram truck or van, then head over to Columbian CDJR. We offer the largest selection of Commercial Ram Trucks in the greater Columbiana, OH area. We have a dedicated sales and finance team specializing in commercial vehicle sales. With over 50 qualifying Ram trucks and Vans on our lot at any given time, you are sure to find what you are looking for. Our finance team is knowledgeable and patient, and they will take as much time as you to explain all your options. We strive to work with each customer to ensure their satisfaction. Plus, we are a certified Comercial Ram dealer, which means we can also offer you Ram’s On The Job incentives to help your business succeed. It is always a good idea to consult your tax professional to determine if your vehicle qualifies.

May not represent actual vehicle. (Options, colors, trim and body style may vary)

Max payload/towing estimate ratings shown. Additional options, equipment, passengers, and cargo weight may affect payload/towing weights. See dealer for details.